Just as a plane needs a flight plan to safely reach its destination, business owners, professionals, executives and their families need comprehensive financial plans to successfully complete their multidecade financial journeys.

I launched Keating Wealth Management to help successful people navigate the economic implications of life transitions and simplify their lives. I made the deliberate decision to establish a two-person firm, with myself as the sole financial adviser and a capable colleague to manage all operational matters.

Because of my direct and complete involvement in each aspect of every client relationship, it soon became clear that I could share my singular expertise with only a limited number of families.

Metaphorically, we think of our firm as a small but well-appointed ship, with 50 staterooms reserved for valued members of our community. By necessity, we must select those members with care, ensuring that every household we serve is compatible with our criteria, enabling maximum value for all. Our relationships are deeply personal and lasting.

Most of our clients are business owners, corporate executives and capital markets professionals. With my extensive Wall Street and Silicon Valley experience, I am uniquely qualified to advise on situations ranging from multimillion-dollar business deals to multigenerational wealth planning.

Free from all conflicts, I am an objective voice that clients can trust unconditionally. If you are seeking high-touch service from a knowledgeable, trustworthy, genuinely independent adviser, we might be a good match.

Regardless of whether you have ever worked with a financial adviser, our “19 Questions to Ask a Financial Adviser,” populated with our responses, will help you cut through the clutter and gain clarity about where we stand on essential issues.

The minimum household account size for new relationships is $2 million. This requirement, combined with our cap on the number of families we serve, enables us to devote the necessary time and effort to each client’s financial planning and investment management needs. We will consider exceptions for young business owners and professionals who are likely to match our client community financial profile over time, subject to a $1,500 per month minimum fee.

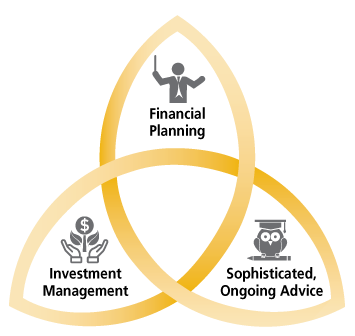

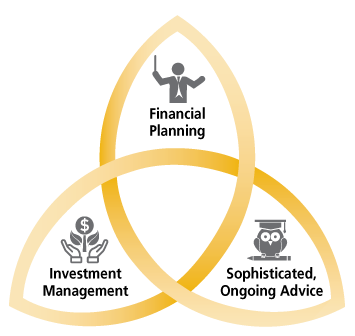

As a Keating Wealth Management client, you’ll benefit from comprehensive financial planning geared to your individual situation. Your personalized Financial Plan is just one component of the full suite of advisory services we provide.

Data sources: Morningstar and J.P. Morgan Asset Management (as of December 31, 2020).