What Price Certainty?

As humans, we have a fundamental, biological need for certainty. This is particularly true in our financial lives, where we require certainty of income to create household budgets and prudently plan for retirement.

And what’s not to love about bonds, particularly those issued by the U.S. Treasury, in this regard? Safety of principal? Check. Fixed and predictable interest payments? Check.

Common stocks, in sharp contrast, are quite uncertain in the short run. Stock prices usually fluctuate widely—although 2017 was an outlier, with extremely low volatility. Optimism can lead to excessive valuations, dampening return potential in the future, and dividend yields have been declining for decades. Averaging just under 2%, dividend yields are currently as low as they have ever been over the past 90 years.

Given all these uncertainties, investors may seek the perceived safety of the certainty offered by bonds. The catch, of course, is high price of this certainty. And the biggest behavioral challenge for all investors is to practice rationality in the face of uncertainty.

Given the fear and loathing of the current equities bull market that turned nine years old in March 2018, bonds may be an appealing alternative asset class to some. But before you buy, consider the price of three huge problems with bonds based on current market metrics.

Three Problems With Bonds

- Today’s yield is likely your total return. Two prominent Princetonians, Vanguard founder John Bogle and economics professor Burton Malkiel, independently researched the predictive power of current bond yields on 10-year future returns and reached the same conclusion: “Over the long run, the yield that a bond investor receives is approximated by the yield to maturity of the bond at the time it is purchased” (Malkiel, A Random Walk Down Wall Street, 11th edition). Bogle’s research looked at rolling 10-year periods going back to 1906 and determined that about 90% of the subsequent returns on bonds are explained by their initial yields. Capital gains and losses have almost no impact on total return. As of the end of April 2018, the 10-year Treasury yield was a hair under 3%. Based on historical probabilities, this is also likely to be the average total annual return for these notes over the coming decade.

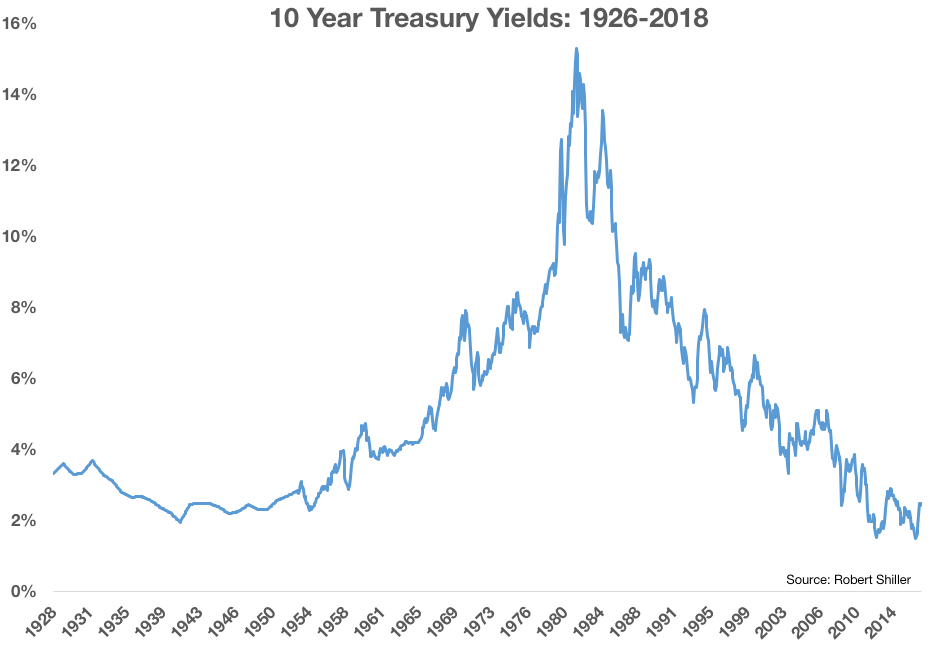

- There is no such thing as a “normalized” interest rate environment. As the chart below illustrates, 10-year Treasury yields peaked just above 15% in 1981. Then, bonds enjoyed a historically unprecedented 30-year bull market—which is now over. Average yields are calculable over any historical period, but what interest rate and corresponding return assumption should a planner use when modeling a three- or four-decade time horizon, as would prudently be required in creating a financial plan for a 50-year-old? And what would be the impact on the probability of success of the plan (relative to achievement of financial goals) if there is a major forecasting error? Good luck.

- Inflation eats more than half of bond returns. Since 1926, the total return from large-cap stocks has been about 10%, and the return from investment-grade corporate bonds has been about 6% (source: Morningstar). Over that same period, inflation has averaged 3%. So equities have delivered a 7% return after inflation, which is more than double the 3% real return for bonds. With today’s 10-year Treasury yield of 3% and a core inflation rate of about 2%, the current real return for bonds is about 1%.

Redefining Risk in Terms of Purchasing Power

The fundamental planning challenges for individuals are no different than those faced by pension and endowment investors. With three- and four-decade retirements, individuals must define risk not just in terms of principal but in terms of purchasing power.

Warren Buffett, in his 2017 letter to Berkshire Hathaway shareholders, contextualized the relative riskiness of stocks and bonds as follows:

Investing is an activity in which consumption today is foregone in an attempt to allow great consumption at a later date. “Risk” is the possibility that this objective won’t be obtained…I want to quickly acknowledge that in any upcoming day, week or even year, stocks will be riskier—far riskier—than short-term U.S. bonds. As an investor’s investment horizon lengthens, however, a diversified portfolio of U.S. equities becomes progressively less risky than bonds, assuming that the stocks are purchased at a sensible multiple of earnings relative to then-prevailing interest rates.

To be sure, there is an important role for bonds in investors’ portfolios. Bonds are suitable for funding known future commitments that will become due and payable within five years. When purchasing bonds for this purpose, match the duration of the asset with the corresponding maturity of the liability. But buying bonds to diversifying against the “risk” of owning stocks, and where risk has been deceitfully equated to volatility, inevitably depresses portfolio growth in the long run. One of the iron rules of the capital markets is that anything which suppresses volatility must commensurately suppress return.

The essential character of the future is its unknowability. Uncertainty—in the markets and in the world—is the only certainty. We don’t move from periods of uncertainty to periods of certainty; rather, we move from one uncertainty to the next.

Therefore, we believe that history is the best guide—perhaps the only guide—to the long-term future. We’ll never have all the information we want regarding what’s about to happen, because the future is indeed unknowable. Therefore, the rational investor thinks in decades rather than days, relies on historical, long-term average returns to guide asset allocation decisions, and makes changes infrequently.

Behavioral Takeaway

Mental accounting refers to the tendency for people to separate their money into separate accounts based on a variety of subjective criteria, such as the source of the money and the purpose of each account. For example, bonds are for income and stocks are for growth. Convenient and comfortable though this mental compartmentalization may be, it may lead to suboptimal asset allocation and a corresponding adverse impact on lifetime investment returns.