Do Nothing

Have the markets got you confused? Are you trying to figure out why stocks have been doing so well during a pandemic and recession? You’re likely asking the wrong questions.

Here’s a quick recap of the roller coaster-type market activity since Valentine’s Day:

- After the S&P 500 hit an all-time high of 3,386 on February 19, reaction to the novel coronavirus caused the stock market to close in bear market territory in just 16 days— the fastest trip to a bear market ever.

- Stocks continued to plunge, dropping to a low of 2,237 on March 23. This 34% decline from an all-time high in 33 days was also without historical precedent.

- Then equities violently snapped back, recording the best 50 days in American stock market history.

- And as of June 30, the index had recovered nearly all its losses and was down only 4.0% year-to-date. In fact, in Q2 2020, U.S. stocks wrapped up their best quarter in more than 20 years.

- For a different perspective, as of June 30 the S&P 500 was actually up 5.4% from its 2,942 level a year ago (and excluding an additional 2% of dividends during the period).

On the economic front, the world has been combatting the consequences of the greatest pandemic in a century and the worst economic contraction since the Depression 80+ years ago. For an excellent discussion of the various factors affecting market behavior, see Howard Marks’ recent memo, “The Anatomy of a Rally.”

The Two Right Questions

If you’re saving for retirement and other cherished goals, you should have a written, date- and dollar-specific financial plan. Additionally, you must understand and embrace the mindset that your portfolio is the medium to fund your plan so you can achieve your financial goals. Your portfolio construction should be informed by a rational, simple, and easy to understand asset allocation methodology. (As an example, see “Asset Allocation Made Easy.”) Finally, once the plan and portfolio are in place, aside from minor periodic rebalancings, there is nothing left to do except patiently let the plan work, so your portfolio can grow over time.

Any time you find yourself wondering whether you should make any portfolio adjustments, ask yourself these two simple questions:

1. Has any major aspect of my life changed?

2. Have any of my goals changed?

If you answer no to both questions, then there is no need to change your financial plan. And if your plan hasn’t changed, there is absolutely no need to change your portfolio. None. Do nothing.

On the other hand, if your answer to either question is yes, then of course immediately update your plan and portfolio, as necessary.

Unknowability and Uncertainty

The essential character of the future is its unknowability. Uncertainty—in the markets and in the world—is the only certainty. We don’t move from periods of uncertainty to periods of certainty; rather, we move from one uncertainty to the next.

Of course, the thing that markets hate and fear the most is uncertainty. We have no control over the uncertainty, but we can and should have perfect control over how we respond to it. The biggest challenge that investors face, therefore, is one of temperament.

Rational investors think in decades rather than days. They rely on historical, long-term average returns to guide their asset allocation decisions, and they make changes infrequently. And the biggest behavioral challenge for all investors is to practice rationality in the face of uncertainty.

Investors are understandably afraid and are pulling back. They don’t know what to do with their money as they wrestle with historically low interest rates, the uncertainty surrounding the next presidential election, and the potential disintegration of world order, among other worries. Result: They flee market volatility by going to cash.

According to a recent report form Fidelity Investments, nearly a third of its customer age 65 and older had sold all their equity holding between February 15 and May 20.

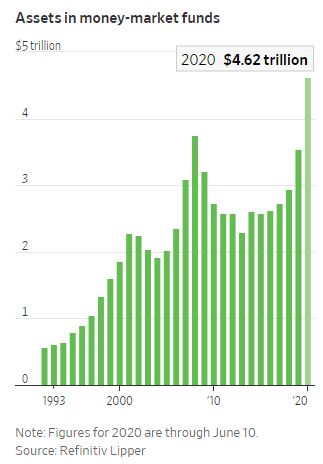

As the following chart from the Wall Street Journal so vividly (and alarmingly) illustrates, assets in money market funds grew by more than $1 trillion in the six months from the end of 2019, topping $4.6 trillion in mid-June. The previous high of $3.8 trillion was during the 2008 financial crisis. A big chunk of this cash belongs to panicking investors who ruin their financial plans by selling when the market tanks, missing out on the growth they could have achieved during the inevitable recovery.

From the March 23 bottom, it took exactly three days—the fastest turnaround ever—for the 20% advance that started a new bull market.

So during periods of market volatility, what should investors do? Keep the volatility in perspective, focus on longer time horizons, and maintain portfolio discipline. That’s it. Unfortunately, this is exceedingly difficult for the average person to do.

Behavior Modification

Despite the fact that most investors are planning for multidecade retirement periods, or even for multigenerational goals, they still check stock prices and their portfolios too frequently—even daily. This makes no sense. In short: It’s never about timing the market; it’s always about time in the market.

In the realm of real-world lifetime investment success, defined properly as the achievement of one’s financial goals, there are three—and only three—determinants that truly matter: financial planning, asset allocation, and behavior. Behavior dwarfs the other two by orders of magnitude.

Behavioral Takeaway

The availability bias is the human tendency to think that examples of things that come readily to mind are more representative than is actually the case. On the positive side, the availability heuristic enables us to make quick decisions and judgments—which, in many of life’s circumstances, can range from beneficial to essential. On the negative side, reacting to recent events can lead to deeply flawed decisions for investment horizons that typically span decades.